This morning, the ESRI has published its latest Quarterly Economic Commentary, which led to George Lee being pushed on Morning Ireland into saying Ireland was the “worst in the developed world” when it came to economic contraction. Fortunately, within the last week, the IMF has produced its latest World Economic Outlook, “Crisis & Recovery“. This contains the latest predictions by the Washington-based organisation on economic output for all countries for this year out to 2014… although to be fair, the focus from most people is understandably on 2009, rather than 2014.

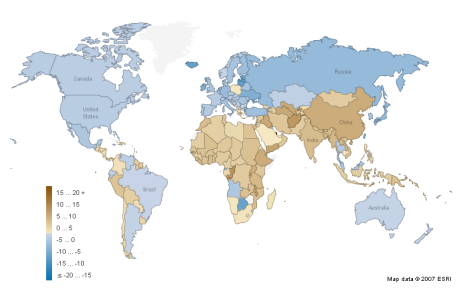

The map below – fully available on Manyeyes – shows estimated GDP growth (or not) by country in 2009, the worst year for the world economy since World War II. Speaking of war, while 27 countries are predicted to have strong growth in 2009, many of them are post-conflict countries, presumably with a lot of spare capacity and/or natural resources, such as Afghanistan, Congo, Ethiopia, Iraq, Laos, Myanmar and Timor Leste. A couple more are simple cases of natural resource-driven economies, such as Qatar and potentially Turkmenistan and Uzbekistan.

Large swathes of the world, almost 70 countries in total, are blue, meaning GDP contraction in 2009. These are concentrated particularly in developed and transition markets, as well as the larger economies of Latin America. A dozen economies face GDP contractions of greater than 5% this year. While Ireland is on the list, it is not a sore thumb, particularly when one looks at countries such as Iceland, Estonia and Singapore, also small open economies. In fact, the whole list of those worst affected this year reads, unfortunately, like a Who’s Who of Washington Consensus poster boys from earlier in the decade:

- Botswana – one of Africa’s few success stories over the past two decades, growing at more than 8% a year until recently

- Estonia, Latvia and Lithuania – three small open economies that had bought heavily into the dream of European integration

- Iceland – no explanation needed, unfortunately

- Ireland – end of the exporting good days… or end of the domestic boom?

- Japan – one of two large economies on the list, facing collapsing export values

- Russia – the other giant on the list, hit more heavily than other resource economies

- Seychelles – a relatively successful and open economy, coming down from a heady 2006/2007 boom

- Singapore and Taiwan – two of Asia’s most successful exporters in the good days

- Ukraine – again, a very strong economic performance since 2000, with natural resources playing their part

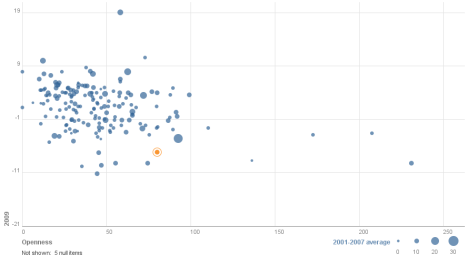

Largely speaking, these, the worst hit economies of the 2009 recession, are open economies and in many cases small ones too. I thought it would be worth investigating across the entire pool of almost 200 economies whether there was a correlation between 2009 performance and (1) openness and (2) 2001-2007 ‘trend’ growth. The full visualization is here (you can play with the axes, highlight your own country – Ireland highlighted below, flip the chart, etc..), but for the overall story, see below.

A quick guide to how to read it:

- The further down a country is, the greater its GDP contraction this year. (Qatar’s expected phenomenal 20% growth this year – oh, to have gas reserves! – actually stretches out the axes a little more than ideal.)

- The further to the right a country is, the more open it is, as measured by World Bank trade-GDP ratios. (The three trade-a-holics, Singapore, Hong Kong and Luxembourg, again stretch this out a little – closely followed, incidentally, by the Seychelles.)

- And if two dimensions weren’t enough, the size of the bubble represents average growth between 2001 and 2007.

While not a perfect correlation, it’s pretty clear that more open economies are facing into tougher economic times. Two quick and related concluding remarks. Firstly, a second glance back at the map shows that Africa and Asia are the best performing continental economies this year. I doubt it’s a coincidence that the vast bulk of population growth over the coming two decades will be from these two regions. The slow but steady formalization of markets continues under the radar in both.

The second point builds on this. The story we were all sold in 2007 was one of decoupling. “No matter if the US and Europe go into recession,” went the story, “because the BRICs will rescue us.” Brazil and Russia in particular did not pass that test, but China and India have fared better. Both economies do look like coming in about 5 percentage points below 2001-2007 trend growth this year, which may certainly feel recession-esque, particular with global euphoria and expansion a thing of the past. Nonetheless, they are still among the fastest growing economies in the world, forecast at above 5% in 2009. China and India are also by the largest of the BRIC countries, with almost 30% of the world’s population, suggesting that they have a critical mass of domestic demand that Brazil and Russia lack.

Filed under: 2 World Economy | Tagged: 2009, afghanistan, africa, asia, baltic, botswana, brazil, bric, china, congo, economic growth, estonia, ethiopia, hong kong, iceland, imf, india, iraq, japan, laos, latvia, lithuania, luxembourg, manyeyes, myanmar, qatar, recession, russia, seychelles, singapore, taiwan, timor leste, turkmenistan, ukraine, uzbekistan, world economic outlook | 5 Comments »