Introducing the daft report earlier this year, Gerard O’Neill discussed the possibility that we might become a nation of renters. On the other hand, there is a lot of talk at the moment, particularly from those selling homes such as these guys in Palmerstown, about how it is significantly cheaper to buy than to rent. I thought it would be worth investigating this a little more, because at the end of the day, despite all the crazy economic goings-on of the past three years, people still have to make a decision about where and how to live. Is it cheaper to buy than rent, and if so by how much? How do things look now compared to the boom years and how will things look if house prices and rents continue to fall?

To do this, I had a look at average prices and rents for three-bedroom properties around the country from the start of 2006 on. I wanted to calculate the annual premium for owning your accommodation as opposed to just renting it, bearing in mind mortgage interest relief, prevailing interest rates and changing property values and rents. After all, economic theory would suggest that if you get to own the asset at the end of thirty years of living there, you should pay more than if you don’t.

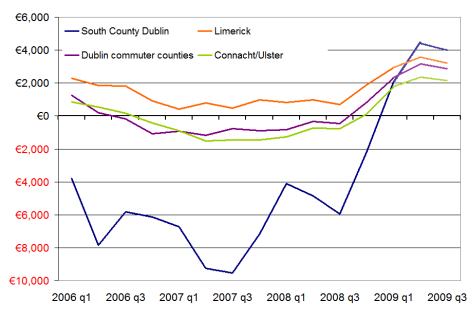

The graph below shows the difference between renting and buying in annual terms for four regions – south County Dublin, Limerick, Dublin’s commuter counties and Connacht/Ulster outside of Galway. It’s calculated for a first-time buyer couple, with mortgage interest relief based on the first year of repayments. I’ve taken ECB+1% as the benchmark interest rate – something which of course may only hold for the first year.

Even with property prices the way they were, it was cheaper to buy your house in 2006 than it was to rent it in everywhere around the country except South County Dublin. Generally, first-time buyers in Dublin could expect to save at least €2,000 over the course of their first year, while elsewhere they could expect to save about €1,000. Only in South County Dublin were first-time buyers actually paying any premium on ownership – in the order of €4,000 over the year for their three-bedroom home.

Sometimes I look back at 2005 and 2006 and wonder what we were all up to. Given those maths, it’s a bit easier to understand again. Of course, things didn’t stay that way. ECB rates started increasing and by mid-2007, potential first-time buyers were faced with the prospect of a premium on ownership in order of €1,000 over the first year – this at a time of uncertainty over capital values. In South County Dublin, the premium on home ownership for the first year was almost €10,000. It should be noted that in a couple of areas, South Dublin city (i.e. all areas with even postcodes), West Dublin and Limerick, it was cheaper to buy than rent – even when interest rates were at their highest. These areas have repeatedly exhibited the highest yields on residential property (about 4% over the past couple of years – high is relative).

Since late 2008, though, as lower interest rates have kicked in, there has been a dramatic swing in the maths back in favour of home-ownership. In late 2008, if you paid the asking price and got ECB+1% for your mortgage, you could expect to save €1,000 in most parts of the country – and more than €3,000 in Limerick or West Dublin. What’s worth noting is that this is at a time of rapidly falling rents as well as house prices. Looking at Q1 figures, that trend is growing with first-time buyers able to save in the region of €3,000 in their first year of ownership. Even in South County Dublin, a household will save money if they buy rather than rent.

How will these figures look in a year’s time? I’ve put in figures marked 2009 Q2 and Q3 to give an indication of how the buy-or-rent decision might look. I’ve assumed another 20% fall in house prices – that’s about a 40% fall from peak to trough. (If that sounds drastic, probably best not to read David McWilliams’ latest comparison of Ireland and Japan.) For rents, I’ve gone for 33% peak-to-trough fall (again, there are those who argue it could be more). In that scenario, buyers would continue be better off than renters in every part of the country. First-time buyers of three-bedroom properties would expect to save anywhere between €1,800 (West Leinster) and €7,000 (Dublin city centre).

To some extent, this is being driven by mortgage interest relief, which is greatest in Year 1. However, Q1 figures indicate that even if there were no mortgage interest relief, there are areas of the country where it is cheaper to buy than rent. And if house prices fall 40% from peak to trough, and rents fall 33%, it will be cheaper to buy than rent, even with no mortgage interest relief, in all areas of the country apart from South County Dublin.

What about the downside? If there are indeed significant swathes of vacant properties around the country that will continue to put pressure on rents for the next 3-5 years, could both rents and house prices halve from their peak values? If that were the case – meaning the typical three-bedroom home in south Dublin city would cost about €900 a month to rent or cost about €275,000 – the maths in favour of buying still look convincing in Dublin but elsewhere it’s a much tougher call. Without mortgage interest relief, homeowners would have to pay around €1,000 a year over what they’d pay to rent.

The tax system as it currently stands certainly strongly favours home ownership. If the government decides that the balance of emphasis when correcting its fiscal black hole should be on raising taxes rather than cutting expenditure, it may abolish mortgage interest relief and bring in a universal residential property tax. This could significantly alter the maths of buying versus renting and bring about the ‘nation of renters’. As it stands, though, even if rents were to halve over the coming year, the premium people pay to actually own their home appears too small for that to happen.

Filed under: 3 Property Market | Tagged: buy or rent, irish economy, irish property market, property, property market, recession, rental market, rents |

“After all, economic theory would suggest that if you get to own the asset at the end of thirty years of living there, you should pay more than if you don’t.”

Does it? I would have thought renting would always be more expensive. Renting other assets works that way, cars/tvs etc. Could you expand on that point with regards property if you have time?

Hi Bob,

Let me give it some more thought. I think the question is whether the benefits of renting (e.g. mobility, lack of threat of negative equity) outweigh the benefits of owning (e.g. being able to sell the asset or borrow against it). Intuitively, though, everything else being equal, it would make sense that renting is cheaper, otherwise the choice would be to own the asset for less than not owning the asset.

Thanks for the comment,

R

Interesting post Ronan but what premium do you put on the risk of capital depreciation/negative equity?

Here’s a good calculator I found on the New York Times website – simply change $ to € – http://www.nytimes.com/2007/04/10/business/2007_BUYRENT_GRAPHIC.html

Hi John,

Thanks for the comment. Not included in the post, but important as you suggest, is why things are the way they are, i.e. why if things are more affordable now than ever is sales activity so low. I would be very interested in hearing any thoughts you have on how to calculate the perceived assessment of capital value change, i.e. what assumption the typical first-time buyer might have made about the % change in house prices box on your link. I would guess that up until 2007, the assumption was something along the lines of 5% per annum over any given period. Now, I would imagine that people are expecting -10% per annum for another year or two and then 0-3% thereafter.

It would nice to ‘reveal’ this figure and how it’s changed from some other figures, but I’m not sure off the top of my head how. Will give it a think,

R

Hi Ronan,

The ongoing absence of demand even as property market becomes more affordable is caused by the absence of confidence in the property market/economy. I don’t buy that it is all a banking system/liquidity problem – people simply don’t want to catch knives that still have a long way to fall.

Is there such thing as a “Consumer Confidence Index”, something like the CPI, with confidence in various sectors normalized to relative figures? Now that would be interesting (though no doubt it would morph into a derivatives market instantly and then be manipulated/distorted.)

Re your other question about % change in house prices, most FTBs in the past 5-10 years just assumed that their asset would only ever appreciate (because everyone they dealt with told them they would). I have no idea how you measure the % they were assuming but I suspect you’d get different figures for different areas due to the premiums placed on certain locations. 5% would be, I imagine, a minimum for nearly anywhere during the 2002-late 2008 timeframe.

John.

Interesting stuff. But it looks to me like a third strategy – rent then buy – will dominate the buy immediately strategy under almost any plausible scenario for the market, and will probably turn out to dominate rent only. It’s hard for a strategy based on buying before the market bottoms to be the dominant strategy.

Hi Con,

True – I didn’t want to natter on for too long, but one of the obvious implications of the figures is that if it’s as affordable in opportunity cost terms to buy property now as it was when people were hoovering up properties three or four years ago and they’re not doing so, clearly there’s another factor at play – and that factor has to be confidence.

My own belief is that the more expensive the property is, the more confidence rather than affordability determines purchasing decisions (compare a €10m house on Palmerston Road with €300k home in Palmerstown). The logical conclusion of these two beliefs is that purchasing will resume at the lower end of the market first.

Thanks for the comment as per usual,

Ronan.

What about the costs of maintaining the property, something that a renter does not need to concern themselves with. In my experience this is a seizable cost over a 30 year mortgage.

International comparison of yields in housing bubble countries, including Ireland, is available here:

http://www.newsneconomics.com/2009/05/housing-bubbles-around-world-looks.html

Daft’s asking prices are very useful for identifying trends, but can’t provide a snapshot of transaction prices, especially with the market in disequilibrium, and the PTSB Index is generally believed to be significantly underestimating the rate of decline.

Ordinary buyers (and sellers) are having difficulty determining current FMVs, never mind pricing the risk of negative equity.

Are disequilibrium and information problems in a positive feedback loop in the Irish housing market?

Hi Paul,

Thanks for the comment – I agree, hence the use of asking-10% as a somewhat blanket solution to the issue you raised.

I think disequilibrium and information problems are indeed reinforcing each other. As a example in the opposite direction, asking prices rose in the UK recently, presumably as sellers saw closing prices rise for two months in a row earlier in the year. If the market were to fall again later in the year, that may seem to prove that sellers took the information they liked and reacted to it, rather than actually proving a dead-cat bounce/pause.

R

There seems to be much less deviation in rents than in asking prices. I get the impression renters at the lower end of the scale overpay but this situation is reversed further up. E.g.. The differential in the rent (in Dublin) between a 3-bed house in a good area and a 1-bed apartment in a not so-good area, is much less than the purchase price differential between the same. This complicates matters, because purchasing is much more permanent. Just because you could buy the lower quality property for less than you can rent it, doesn’t mean you should, especially in a falling market.

For ourselves, it is much cheaper to rent the house we live in than it would be to pay the mortgage on it.

Very good point and it’s worth my saying here that at caveat to the yield series calculated is that they are not taking full account of quality, they are merely looking at average price per segment. Also, to preserve clarity of message/sanity, I only worked on three-bedroom houses – particularly because I wanted to avoid being accused of recommending people by one-bedroom properties. I may have a look at other bedroom segments in due course.

Thanks for the comment,

R

Hi Ronan

Hope all is well

I created a similar graph from Jan 02 to Jan 09 for national data, using ESRI/TSB for house prices and daft for rents. I used ECB + 1.69% as the interest rate. There may be more accurate data available from Central Bank.

The graph is very volatile because changes in interest rates have such an affect on the interest portion of the loan. The interesting periods are when interest rates are stable for a long period of time.

ECB rates were 3.25% from January 02 until Nov 02. The “premium” associated with renting reduced month on month from €375 in January to €175 in November.

ECB rates were 2% from June 03 to Nov 05. The “premium” associated with renting reduced month on month from €310 in Jun 03 to €175 in Sept 05 and it stayed constant at €175 until December when the ECB rate changed.

Finally, from July 07 to July 08, ECB rates were at 4%. It was the premium associated with buying that reduced in this time period. It reduced month on month from €275 in July 07 to €175 in April 07 where it stayed constant until the next ECB rate change in August.

On further examination, the “premium” appears to be moving towards an equilibrium after every ECB rate change, and is only thrown off course by another ECB rate change.

As for the causes of a reduction in the price of rents – No doubt increased supply is a factor. But this has been slow to affect rents. Newspapers have been reporting developers dumping properties on the rental market since the slowdown since early 2007. The drastic falls in rent are more recent. Perhaps because of reduced demand due to net outward migration. if 78,106 people left the country between Nov 07 and Oct 08, God only knows how many have left so far in 2009

While the figures used might show one result there are certain factors that have not been considered.

What about the maintenance costs? What about the occupants elligibility for a mortgage? What about the wider choice of domiciles that renting would allow over buying?

Ireland as a nation is still too much focused on the “rent is dead money” philosophy.

Rent is payment for a service, the service is the use of the premises under a rent/lease agreement. Buying is a whole different kettle of fish.

Having owned a house before I now rent (with an option to buy). I could not afford to purchase the property that I currently live in as it was valued at 2 mln last year. yet I now enjoy all benefits that living here give.

Friends that live nearby own houses half the value of the one I live in, pay double my rent in mortgage payments AND have to pay for the maintenance of the property. They also do not own it until they finish paying up the mortgage.

Again, this is my situation but it illustrates that there is more than figures to measure the cost of renting over living…

Hi Evert,

Thanks for the comment. Of course you’re right, these figures only show the tip of the iceberg, so to speak. While they include a significant amount of countable factors, such as prevailing house prices, rents, mortgage interest relief schemes, mortgage terms, interest rates, etc., they can’t include everything countable, not least uncountable things which count, such as perceptions of risk, prevailing attitudes towards home ownership, and so on.

I find it interesting, though, that while you do practice what you preach – you rent now, having once bought – you know exactly what your mortgage payments would have to be to buy it. This suggests that if the graph above applied to you, you’d buy! Or am I doing you a disservice? Presumably, if your house is valued at 2mn, the blue line above is most similar to your own rent-buy line, which presumably is interesting to you?