With Davy Stockbrokers predicting a 70% fall in Irish construction activity from its peak over the coming ‘medium term’ (2009-2011 or so), I though it might be timely to review some headline statistics for Ireland’s property overhang.

Recently, I’ve been peddling the idea that between 2004 and 2007, we were building twice as many homes as we needed and building twice as many for 3/4 years implies building half as many as you need for 6/8 years to return to equilibrium. Does that stack up? Or, put another way, if we start in 2002 with Census statistics on the stock of housing, use Dept of Environment statistics for the period 2002-2008 and turn Davy’s figures into ballpark estimates for 2009-2013, how bleak will things look in five years time?

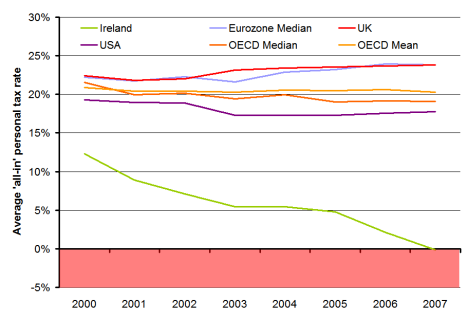

The answer, much to the chagrin of those who loathe two-armed economists, seems to be that it depends – in this instance on what part of the country you’re talking about, but also about what you think is the appropriate long-term need for new houses in this country. If we take 2001 figures (technically March 2002 figures) as our ‘departure from normality’ point, how far off course are we? Between 2002 and 2008, we churned out over half a million properties, off an existing base of just 1.3 million households. Back-of-the-envelope estimates, based on an overview of economists’ figures on this topic, suggests that we should have been building perhaps 300,000 households in that same period. (That’s using an equilibrium figure of 40,000 properties a year, rising temporarily after the accession of new EU member states.) So, enough with all the stats, what’s all this for, you wonder. Well, I was hoping to use all this to answer two key questions:

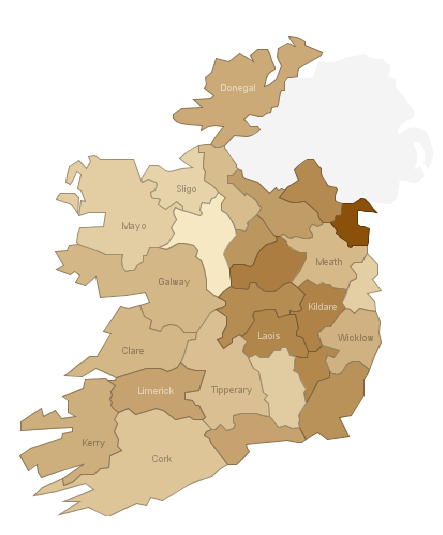

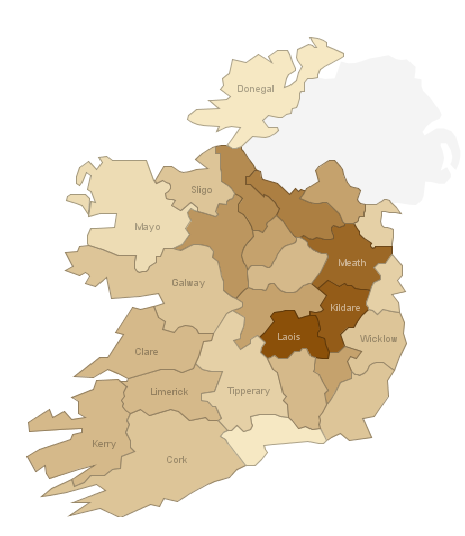

- Where suffered worst from Ireland’s properties building bonanza? Where is housing inventory lying around most?

- How long will we have to sit around building hardly anything until we’re back to some semblance of normality in the property market?

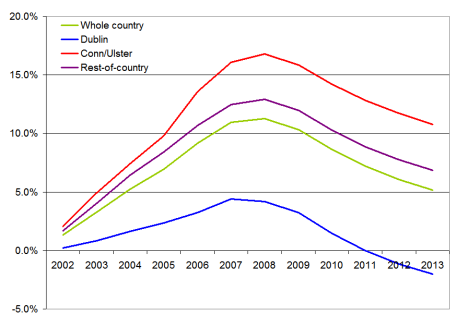

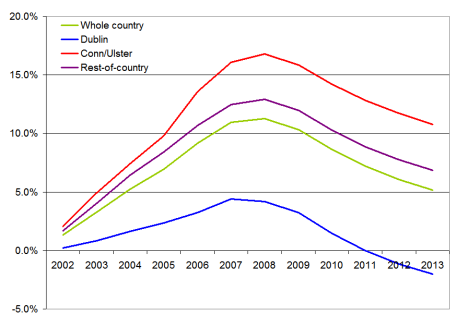

Where did we build our extra properties? By the end of 2008, we were about 5 years ahead of schedule – i.e. we’d built 12 years supply in just 7 years. To give a regional flavour, based on insights gleaned from the property overhang per county figures I calculated in December, I split Ireland into three regions – Dublin, Connacht/Ulster and the rest of the country. (The data allow for a full county-by-county analysis, however time constraints and poor formatting in the various external sources has prevented me from threatening another heatmap!) Over the period in question (2002-2008), more houses were built in Connacht/Ulster than there were in Dublin, which has almost twice the population! As a result, in terms of years of “pre-production”, if you will, while Dublin had under 2 years excess supply by end-2008, Connacht/Ulster had almost 8 years. Once more emphasis: builders managed to produce 15 years output in Connacht/Ulster in just 7 years.

How long will we have to sit around building nothing? It’s all very well for someone to come along after the fact and say “You shouldn’t have done that”. What’s more interesting is to shed some light on where the adjustment will come first and where it will be hardest. One option would be just to close up our construction sector for a few years until inventory shifts sufficiently and prices start to rise. Practically, of course output doesn’t and shouldn’t collapse to zero and, as per Davy’s figures, will be in the range of 10,000 to 25,000 over the coming 5 years.

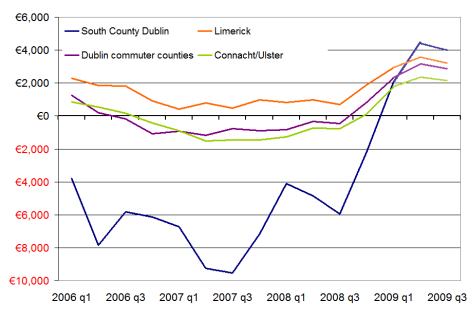

Therefore, I’ve assumed output of 20k in 2009 (still slowing down), 10k in 2010 (bottom of the market) and then a simplistic 5k increase in output every year after that, rising to 25k in 2013. Let’s call this the ‘post-Section 23′ scenario. This is contrasted with a ’20:20 foresight’ scenario where steady-state output in construction remains 40,000, apart from a minor blip of 35,000 in 2009 due to global economic circumstances. In both scenarios, new houses are allocated according to a region based on its Census weight – crucially, and we can relax this later, even in our post-Section 23 world, output resumes in Connacht/Ulster, not at the distorted rates we saw but in proportion to its size. The result of all this is the chart below. The figures show the excess of properties as a percentage of the total property stock in each of the three regions.

Ireland's excess properties, % of total properties, by region, 2003-2013f

The results are pretty clear:

- Even with some major internal restructuring of the construction industry (i.e. rebalancing output of houses according to a region’s weight in the economy), Connacht and Ulster will still have a significant property overhang, more than 10% by 2013 – and that itself based on a drastic 70% contraction in building activity from peak levels.

- For most of the country – and indeed the country on average – the overhang will have halved by 2013 but will still be in the region of 5/6%.

- In Dublin, shortages in housing may emerge as quickly as 2012.

Objections to the above might include one along the following lines: construction will not only contract 70% but also no-one will be building in Connacht/Ulster for years to come so even the rebalancing of output described above is not an accurate forecast. In that case, the overhang will just take the full 8 years from 2008. Section 23 and the property boom will have taken construction jobs from 2009-2015 and left them in 2002-2008 – a sort of integenerational outsourcing.

Another objection is that the optimistic (if 2012 is optimistic) scenario painted for Dublin hinges on that long-term need of 40,000 units a year (which translates into about 12,000 new units in Dublin annually, based on its Census weight). Significant and persistent net outward migration from Dublin from 2009 on – which incidentally is why I believe that Dublin Bus, so clearly an ‘inferior good’ in the economist’s sense of the word, is losing money when incomes fall – might mean that the demand for housing in the period 2009-2013 may fall to 20,000. Replacing 40,000 with 20,000, from 2009 on suggests that the average percentage overhang for the country stays stuck at 10% and Dublin – while still much lower – remains stuck at 3-4%.

In sum, we are where we are. We’ve more than enough houses everywhere in the country and plenty of houses in places where we won’t need them for another 10 years or so. Therefore, it would be wise for the Government to take this crisi-tunity, as Homer Simpson would say, to harness both supply and demand sides of the market.

- On supply, it should focus the efforts of the much-trimmed residential construction industry, when that sector starts to medium-term plan in 2010/2011, on Dublin and other areas around the country most likely to show a shortage of property this side of 2015.

- On demand, the Government should attempt to deliver balanced regional development, taking property overhang as an opportunity for affordable housing to create new centres of employment. Taking this to its most logical conclusion, firms outsource because they want to free up resources to specialize on what they’re good at. Therefore, we must adopt a mentality along the following lines: “Let’s take this opportunity to treat our property boom as intergenerational outsourcing, which has freed us up to focus on what we’re good at.” (Just don’t say all we’re good at is construction!)

Filed under: 1 Irish Economy, 3 Property Market | Tagged: 1 Irish Economy, 2012, 2013, 3 Property Market, Celtic Tiger, economic downturn, economic forecast, ireland, irish property market, irish-property, property, recession, Section 23 | 5 Comments »