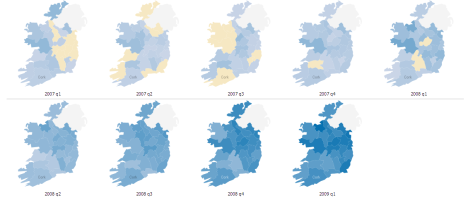

The latest Daft.ie Rental Report is out today. It shows that rents across the country fell by more than 5% in the first three months of the year. The national average rent now stands at €840 per month, compared to just over €1,000 per month a year ago. Nationwide, rents have now fallen for 14 consecutive months. The fall since the peak early last year has been faster than the rise before that, and with rents 17.5% lower than the peak in early 2008, rents are now back mid-2005 levels.

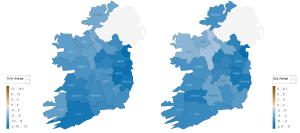

The largest falls in rents have been in the cities. In Dublin and Limerick, rents fell by up to 6.5% in the first three months of the year. In Waterford and Cork cities, rents fell by 5.3% and 5.1% respectively. In Galway, the fall in rents was smaller, at 4.3%. Rents in Dublin’s commuter counties and in West Leinster (i.e. Laois, Longford, Offaly and Westmeath) – presumably an indication of their role as Dublin’s outer and further-outer commuter belts – have fallen by about 6%, more than the national average. At the other end, South-East Leinster (Carlow, Kilkeny and Wexford) and the counties of Connacht and Ulster have seen rents fall by less, typically by about 3.5%. Rents in Leitrim and Roscommon fell by less than 1.5%.

The county-by-county changes are outlined in the map below. As you can see, it’s the extended Dublin area that’s being hit most. For the full details on average rents by county and how much they’ve fallen in the last three months and in the last 12 months, check out the Manyeyes visualization here.

The reason for all this is clear – the rental market is feeling the brunt of too much supply and not enough demand. On the supply side, the number of properties available for rent is now over 23,000 – an all time high, certainly compared with the 5000-6000 range we saw on the site up to 2007. This means that landlords are having to fight for tenants, pushing down rents – and rent-a-room income – pretty much everywhere. Add to this falling demand, as Ireland’s most footloose workers head off to pastures new, and it’s pretty clear that the pressure on rents throughout 2009 and maybe into 2010 will be downward pressure.

This report’s commentary is provided by Brian Devine, Chief Economist at NCB Stockbrokers. He highlights the challenges and perils of forecasting facing economists today:

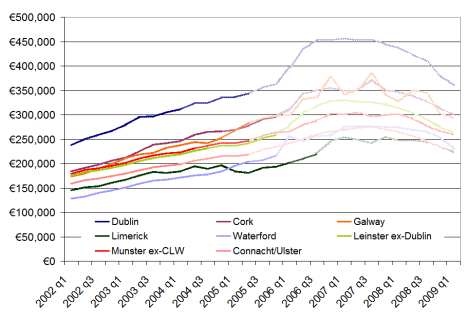

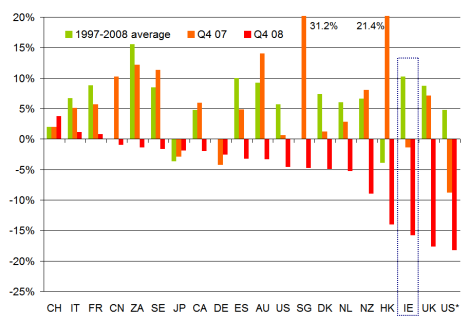

In relation to the property market there have been plenty of forecasts regarding how far residential prices (ranging from -35% to -60%) and to a lesser extent residential rents (ranging from -20% to -35%) are going to fall from peak to trough. Some studies/views on how far prices will fall are based on historical comparisons with previous OECD housing busts. Others invoke the idea of a “fair value” for housing based on, for example, one or more of the following: income-price ratios, mortgage repayment burden, rent-price ratios, rental yield, credit availability, population growth, interest rates and growth in per capita disposable income.

The problem with trying to forecast prices/rents based on the concept of fair value is that prices overshoot and undershoot fair value. The magnitude of the overshoot/undershoot is ultimately determined by psychology. While the psychology of never ending price rises fuelled the market on the way up, economic/job uncertainty and the expectations of further price falls will be the important psychological factors on the way down.

Next week’s property market post will have a look at affordability, i.e. the maths of buying versus renting, based on these figures, and how yields have been affected by the latest falls in rents.

Filed under: 3 Property Market | Tagged: carlow, cork, daft report, daft.ie, dublin, galway, irish rental market, irish rents, kilkenny, laois, limerick, longford, offaly, property, rent, rental market, westmeath, wexford | 3 Comments »