A couple of weeks ago, I discussed the likely extent of the problem of negative equity and homes worth less than when they were bought. This had led to a rich vein of suggested blog posts as extensions, including last week’s look at which counties have suffered most from “unexpected” unemployment since the start of the recession.

That post was a first step towards estimating how many households are faced with both unemployment and negative equity. Today’s post is an intermediate step: how many mortgage-holders are unemployed? How does this vary across counties? And what would it look like if the Live Register were to hit 500,000, as some have suggested it might?

There are about 1.7 million households in the country – almost 600,000 were mortgage-holders in the Census of 2006 and they have been joined by another 90,000 or so first-time buyers since then. (Landlords and buy-to-let investors are of course another issue, but I’ll leave them out for the moment.) At the same time, since the Census, the number on the Live Register has increased from 155,000 to 385,000, meaning there are about 230,000 “unexpected unemployed” around the country, many of whom would have bought property at some point over the last decade or two assuming a stable employment situation.

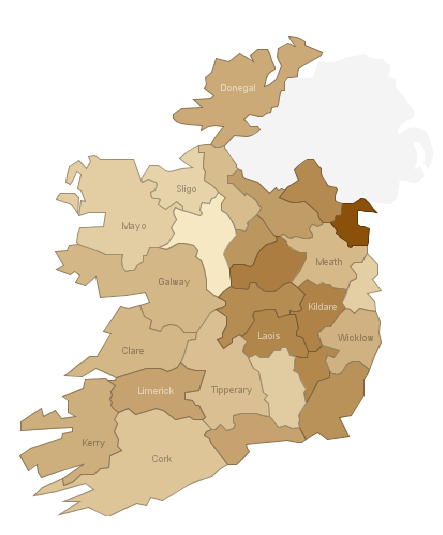

Working out how many of those two groups intersect is not a precise science. Given the broad nature of the economic downturn in Ireland, I have assumed that unemployment has been indiscriminate across working households, i.e. of the 230,000 new unemployed, 55% are in homes with a mortgage, the same ratio in the broader labour force. The map below gives the approximate percentage of households with a mortgage where one person has become unemployed since the recession started. The national average is about 7% of households with a mortgage (or one in fifteen) are currently faced with unemployment.

It might be useful to walk through one county to explain in more detail. In Louth, where there are 44,000 households, about 14,000 of them are more than likely households with retired (and mortgage-free) inhabitants. Of the remaining 30,000 households, just under 20,000 are owner-occupiers with mortgages. At the same time, almost 9,000 people have been added to the number of unemployed people in Louth in the last two years. Assuming that the spread of unemployment was not related to home ownership status, that would mean that 60% of the new unemployed – or just over 5,000 people – are mortgage-holders. If those figures are at least in the right ballpark, that means that one in eight households with a mortgage in Louth is dealing with unemployment.

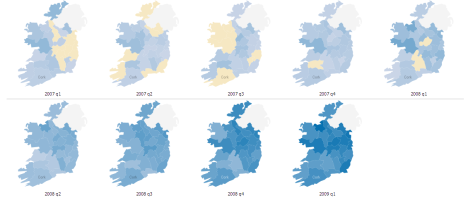

If you go to the original Manyeyes visualization, you can also look at the 2010 scenario of 500,000 on the Live Register, which assumes that the future increase in unemployment is distributed the same way the increase in the last 24 months has been. Because of that assumption, the regional dynamics don’t change – Leinster is still clearly worst affected – but the national headline naturally worsens. In that scenario, 10% of mortgage-holders would be faced with the problem of unemployment.

The final piece of the puzzle – next week’s post – is estimating how many of those who are unexpectedly unemployed and who have a mortgage are faced with the loan on their property being greater than that property’s current value.

Filed under: 1 Irish Economy | Tagged: irish property market, louth, manyeyes, negative equity, recession | 12 Comments »